The Confidence Gap: Consumers and CEOs on Today’s Economy

Overview

The beginning of 2025 saw a significant divergence between the nation’s consumers and business executives in their outlook on the economy, with consumers bracing for a fall and CEOs anticipating a bright future.

Today the two groups are more in line with each other, both expressing concerns about tariffs, rising prices, inflation, and a potential recession sometime this year.

Drawing on research from The Conference Board and Chief Executive, we examine consumer and CEO confidence in the economy in the first few months of the Trump administration, starting with consumers.

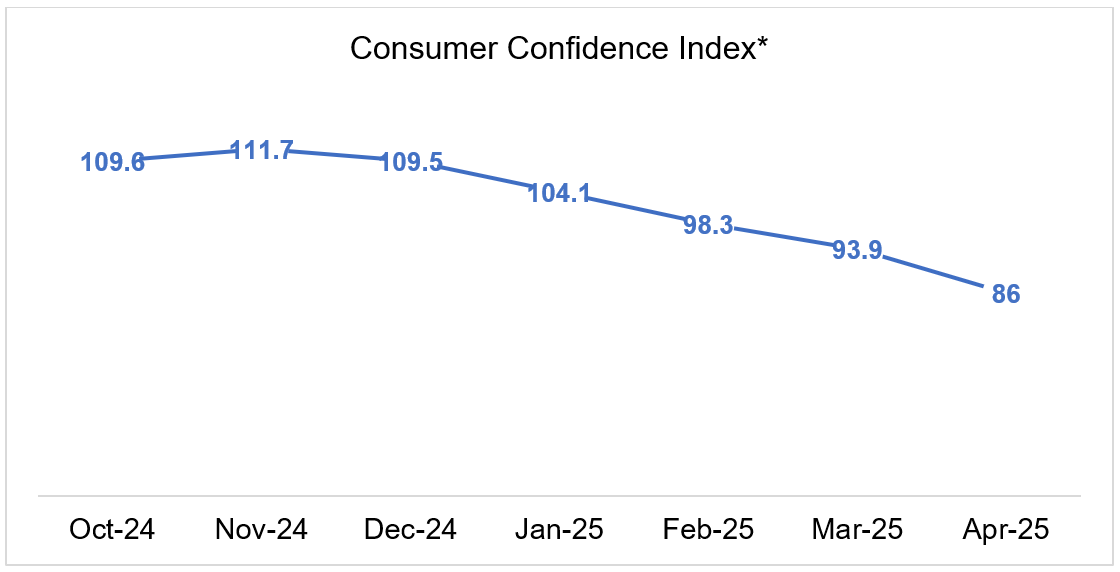

Consumer confidence in the economy has plummeted this year

After a slight uptick right after the presidential election, Consumer confidence in the US economy has fallen consistently each month for the past five months. According to The Conference Board, consumer confidence in the economy dropped by nearly 8 points between March and April, reaching lows last seen at the beginning of the COVID-19 pandemic.

*Source: The Conference Board https://www.conference-board.org/us/

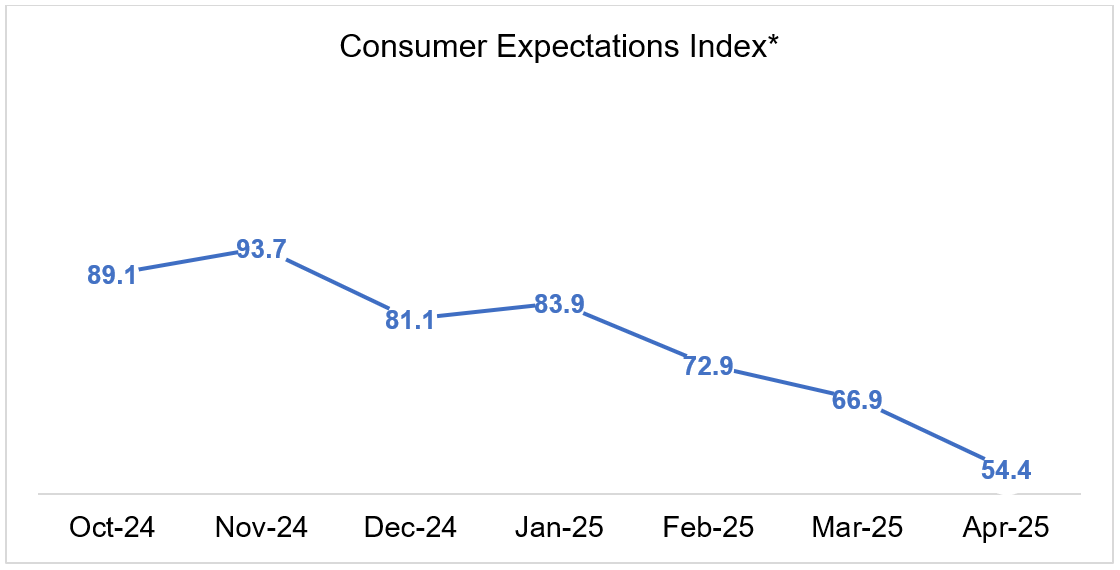

Yet, The Conference Board Confidence Index masks even greater worries about the future. The Confidence Index combines data about consumers’ current situation and their future expectations. While consumers’ current financial situation has deteriorated slightly month to month, their expectations about the future have declined significantly. Indeed, according to The Conference Board’s “Consumer Expectations Index,” consumer confidence in the future has dropped every month this year, declining another 12 points in April, to 54.4, its lowest level since the 2009 recession.

*Source: The Conference Board https://www.conference-board.org/us/

Consumers are increasingly concerned about tariffs and their potential to exacerbate already high prices, along with recent hits to their retirement savings and investments. Consumers are also worried about a tightening job market and declining wages.

Uncertainty about the future has already impacted consumer spending, with more consumers saying that they are holding back on major purchases such as homes, cars and vacations.

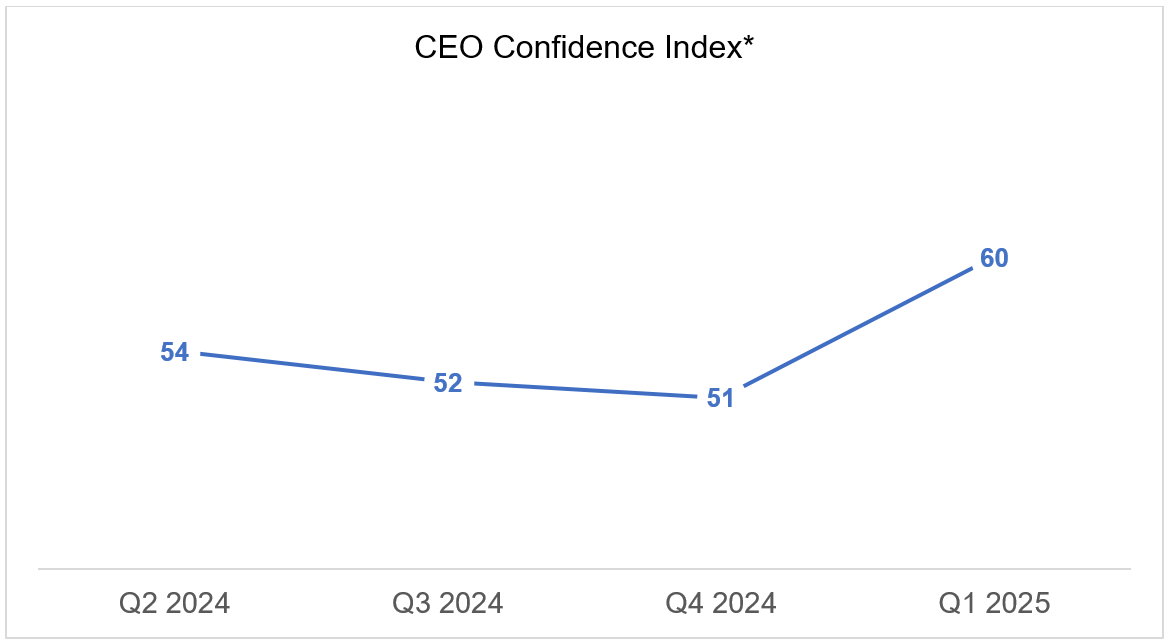

US CEOs were originally much more optimistic than consumers

In stark contrast, after slight declines in each quarter of 2024, The Conference Board’s Q1 2025 survey of US CEOs, conducted in late January to early February, found CEO confidence in the economy surging at the beginning of this year, up 9 points in the first quarter of 2025, to its highest level in three years.

*Source: The Conference Board https://www.conference-board.org/us/

At the outset of President Trump’s second term, US CEOs expressed “confident optimism” about both their current and future economic conditions.

- In February 2025, 44% of US CEOs said that economic conditions were better than six months prior, up 24 points from Q4 2024.

- Also in February, 56% of CEOs expected economic conditions to improve in the next six months, up 23 points from Q4 2024.

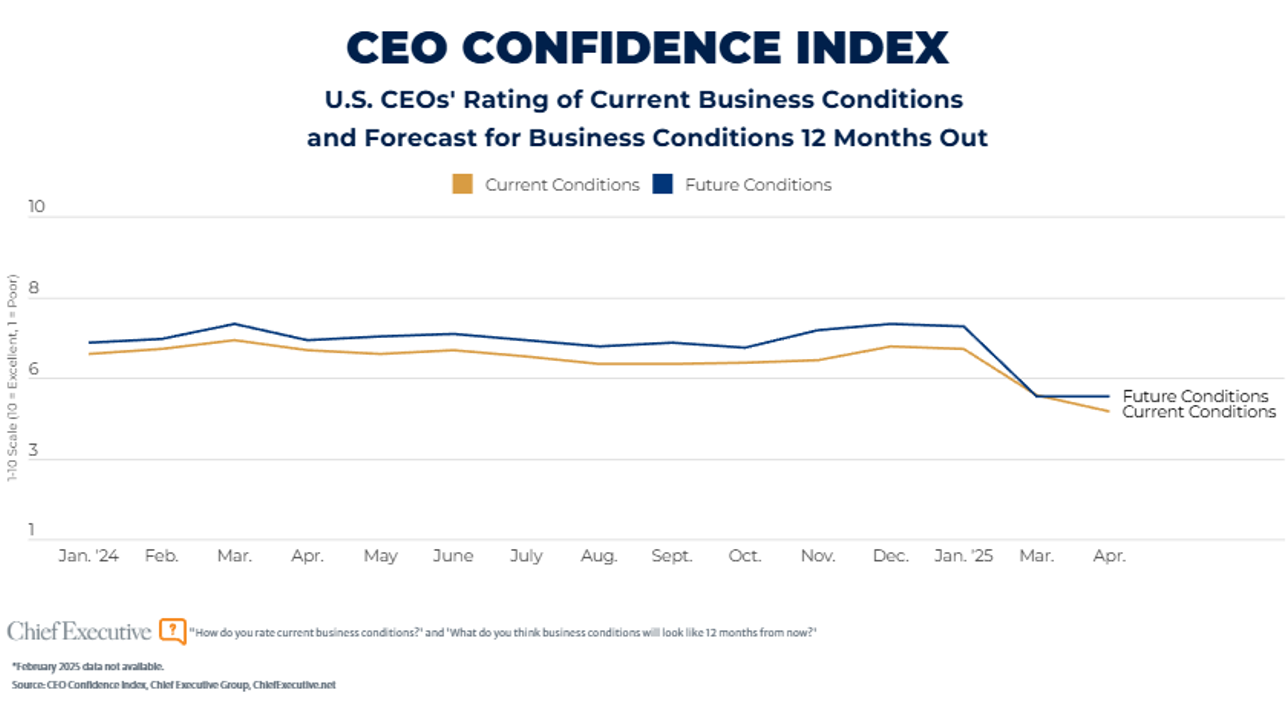

CEO confidence drops in March

Then came the tariff announcements in early February. A survey of US CEOs by Chief Executive found a precipitous decline in CEO confidence beginning in March 2025, as Trump began rolling out his tariff programs and plans. By April, the Chief Executive CEO Confidence Index had dropped to its lowest level since November 2012.

CEOs surveyed by Chief Executive in April 2025 explained that the impending tariffs were the number one reason for their declining optimism.

- 76% of CEOs said that the tariffs would negatively impact their business this year.

- 81% of CEOs expect the cost of goods, services and labor to increase this year.

- 48% of CEOs expect their company’s profits to decrease this year, up from 12 percent in January.

By April, CEOs and consumers were more closely aligned in their economic outlooks.

- Nearly seven in ten consumers said they expect the US to experience a recession in the next 12 months.

- Similarly, over six in ten CEOs said that they expect a recession or economic slowdown in the next six months.

A glimmer of hope in May

With trade negotiations underway, CEOs now see some signs that the tariff fiasco may settle down and CEO optimism has shown a slight uptick in May. While still well below January levels, CEOs now express a little more confidence in the economy than they have for the past couple of months, and just 46% of CEOs expect a recession in the next 6 months, down from 62% in April.

The tariff landscape is far from settled and it is unclear exactly where it will land. Yet, the confidence gap has been incredibly revealing. Consumers have expressed growing concern about the economy for months. By contrast, CEOs began the year with a surge of optimism about the Trump administration which plummeted when the tariffs were announced. While their optimism is resilient, American CEOs may now be more trepidatious about what lies ahead.